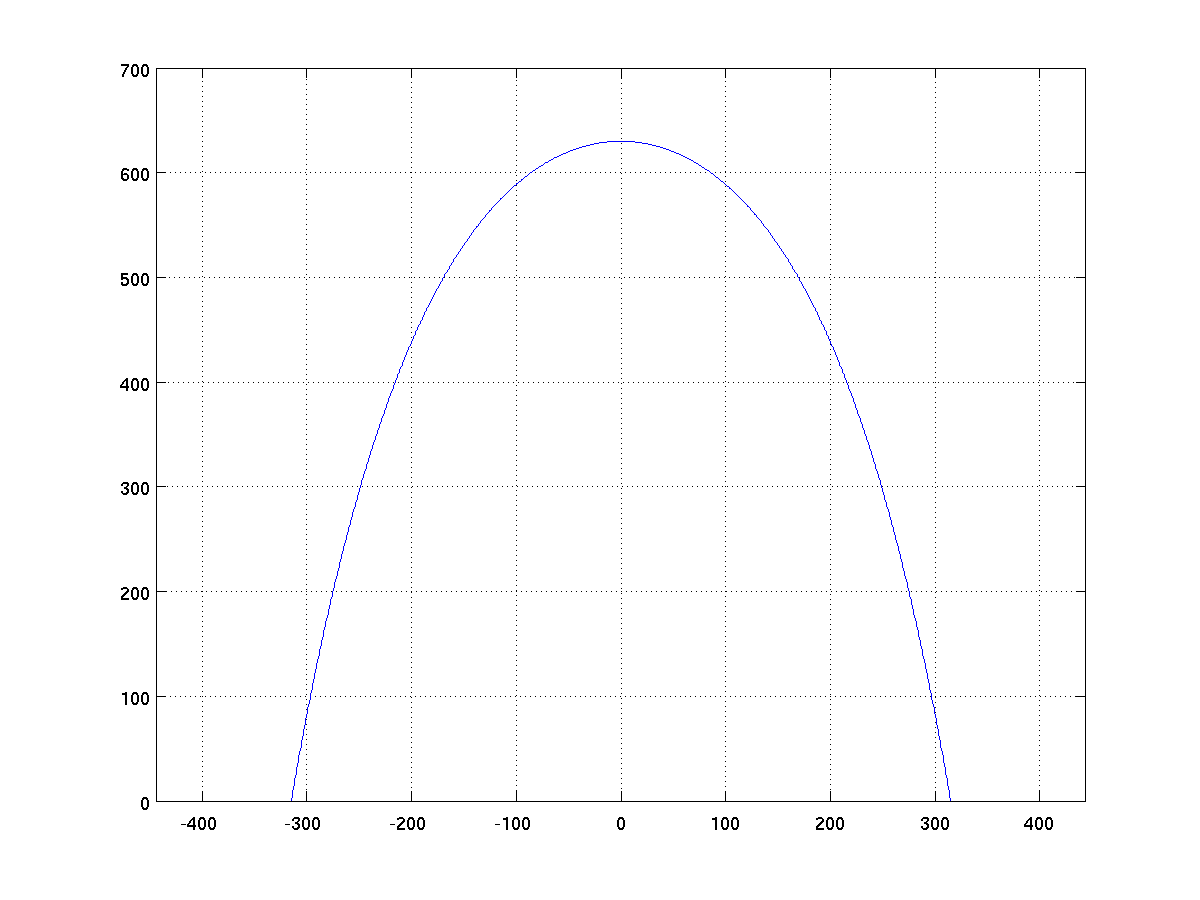

The Gateway Arch is shaped according to the equation:

for x ranging from -330 to 330 and using MATLAB's hyperbolic cosine function (cosh). Create a script arch.m that produces a figure of the arch matching the following style. Note that there is a grid in the background and that the aspect ratio of the graph is square.

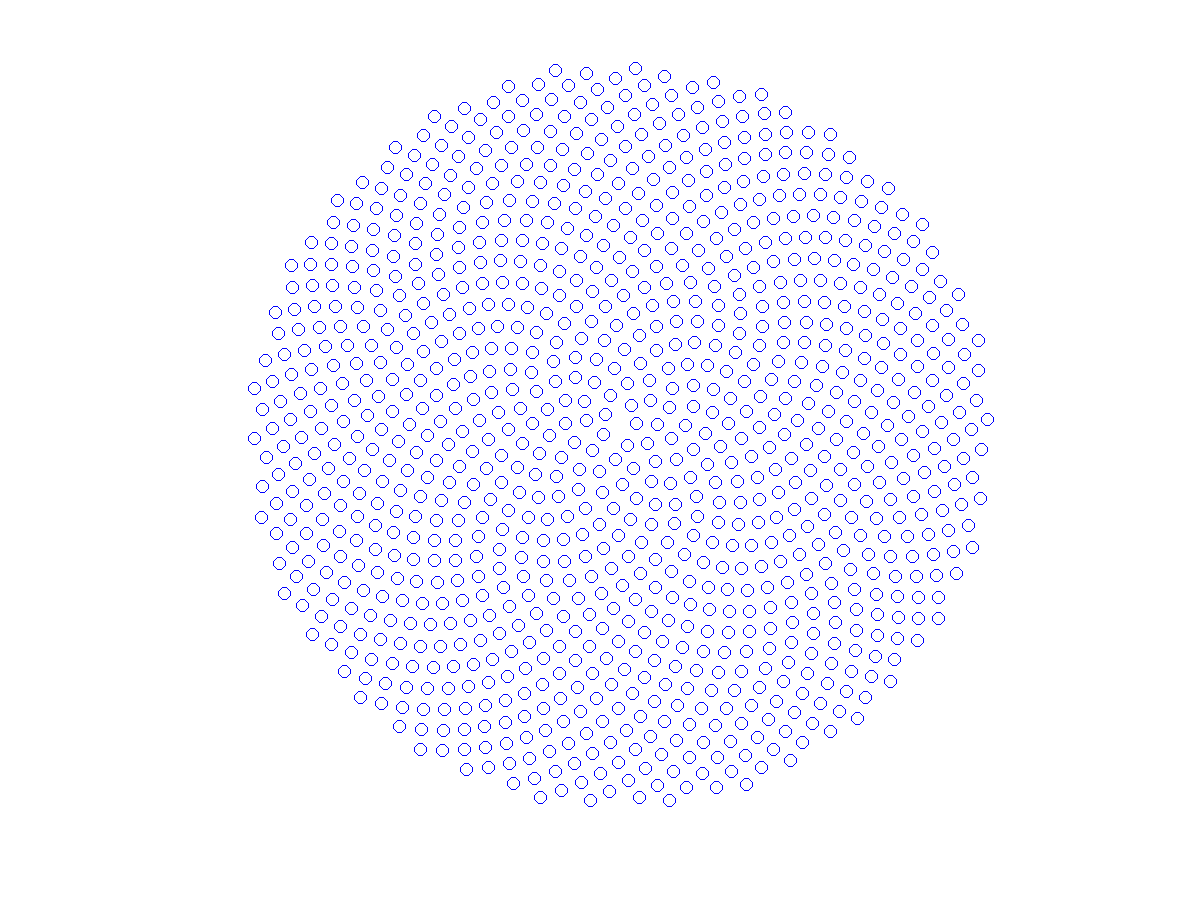

Consider the following rendition of the seeds in a sunflower.

We used the following mathematical model to produce this image. We fix a constant

where

Create a script sunflower.m that produces such a figure (note well that displayed axes are intentionally omitted from the figure, and that the image aspect ratio is square).

For your own amusement you might see what kind of

patterns you get by slightly modifying the value of ![]() , but submit the version with the prescribed value.

, but submit the version with the prescribed value.

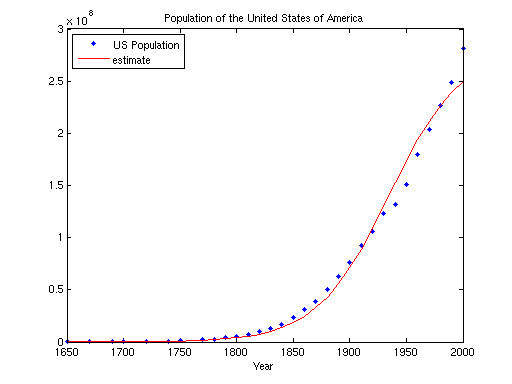

Population growth can often be modeled with the following function:

where

For this problem, we want you to graph the population estimate when compared to the actual data for the U.S. population for the period from 1650 up to 2000. We are providing a text file with the actual raw data (statistics taken from wikipedia). Our file has a simple format, starting as

1650 50400 1670 111900 1690 210400 1700 250900You may download the file population.txt to save in your working directory. It can be loaded from within a MATLAB script with a command such as

pop = load('population.txt');

in which case the variable pop will be set to an array with

n rows and 2 columns.

Write a script population.m that reproduces the following

figure, with the blue dots being the actual data read from the file

and the red line being the estimating function (you can plot the blue

dots in MATLAB by using a line specification of 'b.').

Many financial web sites will display charts similar to the one shown

below showing the price of the Dow Jones Industrial Average as well as

the overall market volume for each day of the most recent year (figure

courtesy of

Yahoo

Finance).

Yahoo also shares its raw data, not

just for the year but for its full history. For this assignment, we

have downloaded the raw data for the Dow Jones going back to 1928.

Our goal is to use MATLAB to reproduce a similar view of the above

timeframe.

We are providing the raw data in a text file (download here), wih one row for each day

of market activity. It is arranged in columns that designate

| Year | Month | Day | Daily Opening Price | Daily High Price | Daily Low Price | Daily Closing Price | Daily Volume |

|---|---|---|---|---|---|---|---|

| 1928 | 10 | 01 | 239.43 | 242.46 | 238.24 | 240.01 | 3500000 |

| 1928 | 10 | 02 | 240.01 | 241.54 | 235.42 | 238.14 | 3850000 |

| ... | |||||||

| 2009 | 01 | 29 | 8373.06 | 8373.06 | 8092.14 | 8149.01 | 5067060000 |

| 2009 | 01 | 30 | 8149.01 | 8243.95 | 7924.88 | 8000.86 | 5350580000 |

Your goal:

You should create a script stocks.m that generates a figure

mimicking the one shown above, as best possible (I do not expect

you to be able to match all of the aestetics for this one). The following

advice will help you.

-

The precise figure above was based on the data from

2008-01-30 through 2009-01-29. The djia.txt file

contains much more historical data than this particular

range. In another week, we will learn to use control

structures to build such figures with more general

techniques.

For this week, feel free to use advanced knowledge about the data set to mimic the figure. In particular, the entry for 2008-01-30 is on row 19919 of that file.

-

There are two subplots. You will need to use the

subplot()function to create one graph with two plots. Although they are drawn with different heights by Yahoo, you may draw them with equal heights in MATLAB (that is the default for subplots).The top portion of the figure is a line graph based upon plotting the daily closing prices.

- Notice that the y-axis is plotted on a logarithmic scale while the x-axis is plotted on a linear scale. This can be accomplished in MATLAB with the semilogy function.

-

By default, the semilogy function draws tick marks for

the y-axis at powers of ten. This can be adjusted to

be at each thousand by using the command

set(gca, 'YTick', 1000 .* [1:20]); set(gca, 'YTickLabel', 1000 .* [1:20]);

-

While we're at it, the tick marks for the y-axis can be

moved to the right-hand side with the command.

set(gca, 'YaxisLocation', 'right');

The bottom figure is a bar graph based upon the daily volume.

- The separation between columns of the bar graph can be achieved in part by sending an extra parameter to the bar function that is the width value (by default, it is 0.8).

- For both portions of the figure, the most difficult aspect to duplicate will be the month labels for the x-axis. Don't worry about this for now, but for those interested we will learn how to do this using control structures.